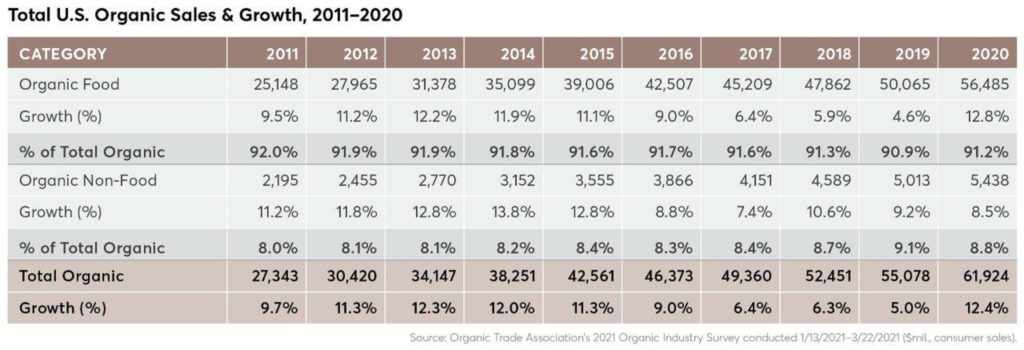

May 25, 2021Nearly $62B US sales in organic reported in 2020

U.S. organic sales soared to new highs in 2020, jumping by a record 12.4% to $61.9 billion. It marked the first time that total sales of organic food and non-food products have surpassed the $60 billion mark, and reflected a growth rate more than twice the 2019 pace of 5%, according to the 2021 Organic Industry Survey released May 25 by the Organic Trade Association.

Black beans, flour, and chicken broth are not typically out of stock. They were in 2020. In that unprecedented year, organic’s reputation of being better for you and the planet positioned it for dramatic growth. In almost every organic food aisle, demand jumped by near-record levels, propelling U.S. organic food sales in 2020 up a record 12.8% to a new high of $56.4 billion. In 2020, almost 6% of the food sold in the United States was certified organic.

The COVID-19 pandemic caused consumer dollars to shift almost overnight from restaurants and carry-out to groceries, with traditional staples and pantry and freezer items flying off the shelves. Consumer habits were upended, online grocery shopping and grocery deliveries exploded, and new products were tried as families ate three meals a day at home.

“The pandemic caused abrupt changes in all of our lives. We’ve been eating at home with our families, and often cooking three meals a day. Good, healthy food has never been more important, and consumers have increasingly sought out the Organic label. Organic purchases have skyrocketed as shoppers choose high-quality organic to feed and nourish their families,” Laura Batcha, CEO and executive director of the Organic Trade Association, said in a news release. Batcha announced the new data at Organic Day at Natural Products Expo West.

Stocking the pantry, refrigerator and freezer with organic

Leading the charge for healthy food was the desire for fresh produce. Fresh organic produce sales rose by nearly 11% in 2020 to sales of $18.2 million. Frozen and canned fruits and vegetables also jumped with frozen sales alone rising by more than 28%. Including frozen, canned and dried products, total sales of organic fruit and vegetables in 2020 were $20.4 billion. More than 15% of the fruits and vegetables sold in this country now are organic.

Pantry stocking was overwhelmingly the main growth driver in 2020. As bread making and cookie baking took kitchens across the country by storm, sales of organic flours and baked goods grew by 30%.

Consumers also turned to “meal support” products to help them in the kitchen. Sales of sauces and spices pushed the $2.4 billion condiments category to a growth rate of 31 percent, and organic spice sales jumped by 51%, more than triple the growth rate of 15% in 2019.

Meat, poultry and fish, the smallest of the organic categories at $1.7 billion, had the second highest growth rate of nearly 25%.

Supply constraints

“The only thing that constrained growth in the organic food sector was supply,” said Angela Jagiello, Director of Education & Insights for the Organic Trade Association. “Across all the organic categories, growth was limited by supply, causing producers, distributors, retailers and brands to wonder where numbers would have peaked if supply could have been met!”

Jagiello, who spearheads the coordination of the survey for the association, also noted that because of the pandemic, not only ingredients were taxed, but packaging – bottle lids, pouches, corrugated cardboard, bottles for dietary supplements – was in short supply as were workers and drivers to transport product, making it hard for producers to ramp up processing to meet consumer demand.

Steady growth in non-food sector

The organic non-food category did not see the same exceptional growth in 2020 as organic food, but its growth held steady with prior years. Sales of organic non-food products reached $5.4 billion, up 8.5% and only slightly below the 9.2% reported in 2019.

Reflecting the pandemic and as in the conventional market, organic sales were driven by personal hygiene, hand sanitizers and cleaning products. Sales of organic household products saw record growth of 20%.

Textiles and fibers, the biggest category of the organic non-food sector, saw sales slow as stores closed, and clothes buying dipped. That said, the category fared better than expected given its ties to brick-and-mortar retail and the shutdown of that sales channel for a significant period of time. For the year, U.S. organic fiber (linens, clothing and other textiles) sales grew at a rate of 5%, compared to 12% in 2019, reaching sales of $2.1 billion.

What’s ahead in the “new normal”

While the growth in organic food sales is not expected to continue at 2020’s fast rate, organic food sales are expected to stay on a strong growth path in 2021. It’s anticipated that the grocery industry at large will get a lasting lift from the pandemic for the foreseeable future as many consumers continue to cook more at home.

“We’ve seen a great many changes during the pandemic, and some of them are here to stay,” said Batcha. “What’s come out of COVID is a renewed awareness of the importance of maintaining our health, and the important role of nutritious food. For more and more consumers, that means organic. We’ll be eating in restaurants again, but many of us will also be eating and cooking more at home. We’ll see more organic everywhere – in the stores and on our plates.”

This year’s survey was conducted early in 2021 from January through March 2021 and was produced on behalf of the Organic Trade Association by Nutrition Business Journal (NBJ). Nearly 200 companies completed a significant portion of the in-depth survey.

The full report can be purchased; online orders can be placed on this page.