May 22, 2019US production of fresh vegetables decreased in 2018

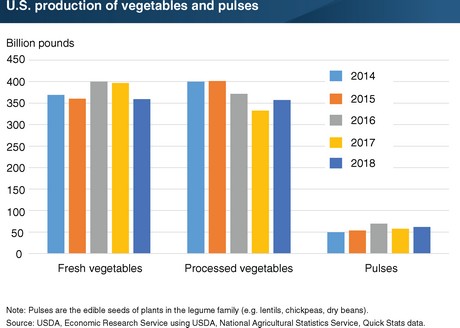

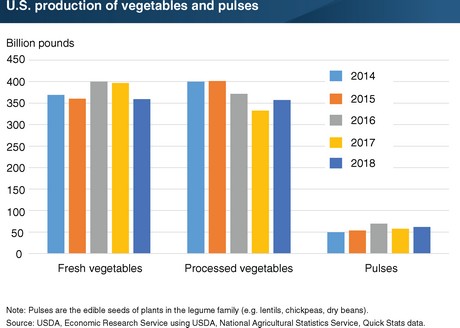

Consumer demand for fresh vegetables in the U.S. remains high, but domestic fresh vegetable production fell 10 percent from 2017 to 2018, marking the largest year-to-year decline of the last 20 years (1999–2018). Furthermore, for the same 20-year period, 2018 domestic fresh vegetable production reached its lowest level at 359 billion pounds, largely the result of diminishing harvested area.

The production decline from 2017 to 2018 coincided with a drop in both area harvested and yields of most fresh-market vegetables – partially driven by above-average heat during the growing season. In contrast, production of processed vegetables grew by over 7 percent in from 2017 to 2018. The increase was almost entirely due to a 17-percent increase in tomato production, which made up 75 percent of processed vegetable volume in the United States.

Divergent trends in the latest year’s production of fresh and processed vegetables can be partially explained by differing states and crop mixes, and each represent a return to approximately 4-year ago levels. Although pulse production is much smaller on a volume basis, production growth relative to 2017 was equally strong. Driven mainly by increases in chickpea production, production of pulses (e.g., chickpeas, lentils, and dry beans) grew by nearly 7 percent from 2017 to 2018.

This chart appears in the ERS Vegetables and Pulses Outlook newsletter, released in May 2019.

U.S. vegetable production

The United States produced 120.7 billion pounds of commercial vegetables (including mushrooms and potatoes) during 2018, down almost 2 percent from 2017, with a value of over $17.5 billion and harvested area of about 3.8 million acres..

The three leading crops, including fresh and processed, were potatoes (45 billion pounds), tomatoes (28 billion pounds), and lettuce (8 billion pounds), which combined accounted for 68 percent of total fresh and processed production volume. Production value fell 12 percent from a year earlier due to lower production volumes and falling prices for most fresh-market vegetables.

California leads the country in total vegetable output, accounting for 60 percent of total annual utilized production of all vegetables in the United States.

All-tomatoes, head lettuce, and romaine lettuce claimed the highest values of utilized production in 2018, generating $1.9 billion, $1.2 billion, and $0.9 billion of farm value, respectively. The value of tomatoes increased over 10 percent in 2018 despite a declining price level. Head and romaine lettuce values declined by 31 and 45 percent respectively in 2018 amid two foodborne illness outbreaks during the first and second half of the year.

The farm value of total U.S. utilized production fell 12 percent to $12.9 billion in 2018 due to lower production and prices for numerous fresh and processed vegetables. California claimed the top State position for total value of vegetable utilized production during 2018, which declined from the previous year despite a 4-percent volume increase.

Fresh-market vegetables sink to record low production

Excluding potatoes, sweet potatoes, and mushrooms, the United States produced 35.9 billion pounds of fresh vegetables in 2018 – down over 9 percent from a year earlier. The production decline from last year coincides with a drop in both area harvested and yields of most fresh-market vegetables. The 2018 production also marks the lowest fresh production in the past 19 years, largely the result of diminishing harvested area.

The change from 2017 to 2018 production levels represents the largest annual fresh-market decline over the period. The four largest fresh-market crops in 2018, in terms of volume, were onions, head lettuce, romaine lettuce, and tomatoes, which combined accounted for 46 percent of the total production (table 2). These four crops also led the decline of total fresh-market production in 2018 as they represented 70 percent of the total 3.7-billion-pound reduction from the previous year.

The production fall was preceded by a contraction of U.S. 2018 planted area of onions, head lettuce, and romaine lettuce to their lowest levels in 17 years. Onion area fell 13 percent from last year, iceberg lettuce fell 15 percent, and romaine lettuce area fell 4 percent. U.S. fresh-market vegetable production increases in 2018 were realized for artichokes, snap beans, carrots, cauliflower, celery, cucumbers, garlic, and spinach.

Onion plantings nationally during the first four months of 2019 have been at their slowest pace in 3 years. As a result, average onion plantings and emergence percentages during mid-April, which have been observed as two variables influencing onion production, are indicating lower final 2019 production.

The downward production potential is likely based on the decline of normal monthly precipitation and a rise in monthly normal temperatures during the critical development period for onions in the major growing regions. Shipping-point and retail onion prices have been rising since the end of 2018 through April 2019.

Average retail yellow onion prices January 2019 through April 2019 are $1.06 per pound – the highest in 8 years for the period. Current 2019 onion shipments are slower than last year, and suggest lower total annual shipments. The prospects of both lower shipments, and 2019 production, indicate support for higher average onion prices throughout 2019.

A notable increase in 2018 carrot production resulted from gains in area harvested and yield for the year. California comprises almost 80 percent of total U.S. fresh-market carrot production.

U.S carrot production surged 18 percent in 2018 after area planted expanded by just under 1 percent and yields by over 1 percent. Fresh-market carrot domestic availability was boosted 16 percent over 2017 despite strong fresh carrot export growth. The fresh-market carrot price received has reacted to changes in planted acreage over the years, and in 2018 the price received fell to $27.30 per cwt from 2017 after carrot planted area increased less than 1 percent.

The USDA, Agricultural Marketing Service (AMS) indicates that fresh carrot shipments through March 2019 from central California are at their fastest pace in 20 years. Concurrently, shipping-point prices began to fall in early 2018 and have sustained the downward trend through 2019.

Processing-market vegetables recover from last year

Production of vegetables for the processing market (excluding potatoes and mushrooms) totaled 34.2 billion pounds in 2018 – up 9 percent from 2017. The majority of individual processing crops reported volume declines, including sweet corn, which declined only 1.8 percent in 2018 and constituted just 15 percent of total processing vegetables and had the second-largest production behind tomatoes.

However tomatoes, which account for three- quarters of total processing volume in 2018, increased 17 percent to 25.6 billion pounds, leading the overall increase of the sector. The rebound of the 2018 tomato volume was primarily due to exceptionally low volume in 2017 caused by lower planted tomato acreage due to California drought concerns and high tomato stocks.

Rebounding tomato production, coupled with growing imports and falling exports for 2018, has boosted total domestic availability and per capita availability for total processing vegetables. California tomato processors are expecting lower processed tomato production for the 2019 season total due to lower area planted, despite expectation of improved yields over last year.