Nov 23, 2020Fresh produce generated $4.86B in sales during October

Eight months into the pandemic, the virus remains in firm control of how and where people spend their food dollar. Everyday sales have been on a slow march back to normal and restaurant transactions had come within 10% of prior year levels.

Come September, many of the pandemic shopping patterns had started to normalize, including comfort levels with being in-store and the time consumers spent browsing for old favorites and new items. During Oct

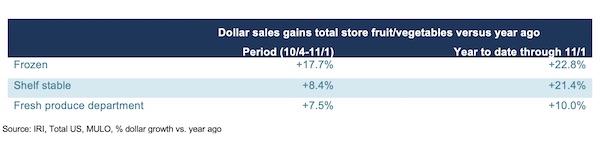

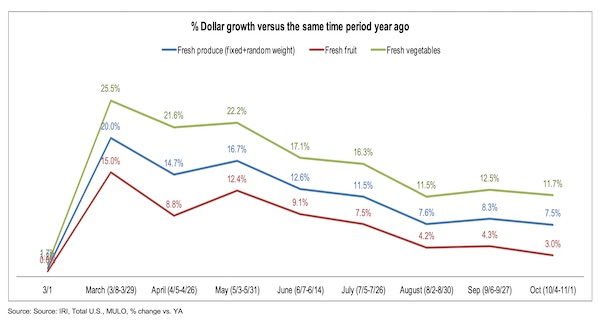

Food spending at retail remained highly elevated for all temperature zones of produce as well. Frozen fruit and vegetable sales are the smallest, but did see above-average gains. Fresh produce was up 7.5% during the October weeks and 10.0% for year-to-date.

Fresh produce generated $4.86 billion in sales during the October weeks – an additional $339 million in sales versus the same time period in 2019. This encompasses $64 million in additional fruit sales and $278 million in additional vegetable sales. Vegetable sales have outpaced fruit sales throughout the pandemic and have generated 34 weeks of double-digit growth since the onset of the pandemic shopping patterns in mid-March.

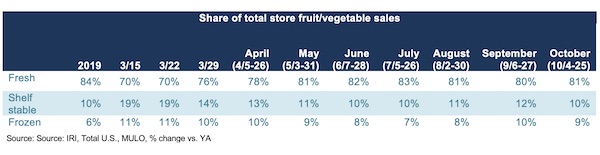

Fresh share

Fresh produce commanded an 81.4% share of total fruit and vegetable sales across all three temperature zones during the October weeks — up a percentage point from its September average of 80.3%. “The fresh share moves up and down a bit depending on the month, but remains down compared with the 2019 level of 84% of sales,” said Jonna Parker, Team Lead for Fresh at IRI. “Consumers still want to have multiple weeks’ worth of food in their freezers, fridges and pantries. In our most recent shopper survey in October, more than three-quarters aimed to buy enough to have one to two weeks worth of groceries and 15% aimed to buy three to four weeks worth. This desire to have backup will likely lead to continued strong sales of frozen and shelf-stable fruits and vegetables in addition to fresh gains.”

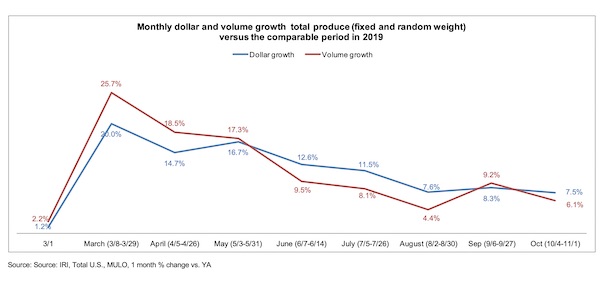

Fresh produce dollars versus volume

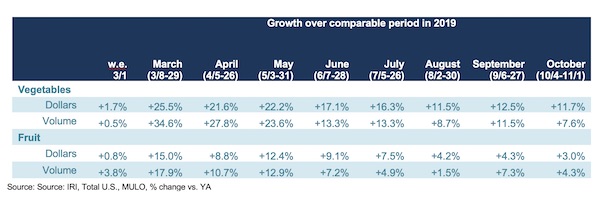

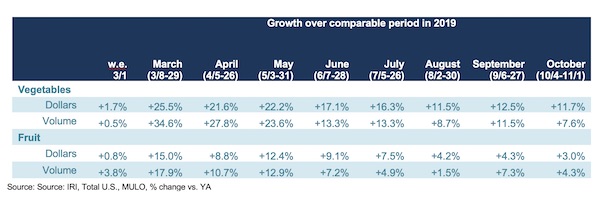

Until May, fresh produce volume gains outpaced dollar gains. That flipped come June and for three months dollar gains outpaced volume gains, which is a sign of inflation. September saw a reversal yet again, with volume up 9.2% and dollars 8.3%, which was driven by aggressive prices during Labor Day in particular. In the weeks ending October 4 through November 1, dollar gains once more exceeded volume gains, at +7.5% versus 6.1%. “Volume at retail was up 6.1% in October versus year ago,” said Watson. “This is down a bit from September that included the Labor Day holiday sales, but up from August. With all the indicators pointing to more of the dollars flowing back into retail, it is likely that we will see a stronger November.”

In vegetables, dollar gains easily exceeded volume gains in October 2020 versus year ago. In fruit, it was the reverse, with a modest increase of 4.3% in volume and 3.0% in dollars. This continues the trend seen in September, when fruit volume gains exceeded dollars for the first time in months.

To read the full report, click here.

– Anne-Marie Roerink, 210 Analytics LLC