Aug 29, 2018Consensus elusive on how big ag company mergers will affect growers

The last 12 months have brought a wave of mergers among heavyweight agriculture companies. Industry groups, analysts and economists have differing forecasts of how specialty crop growers will fare in the new business climate.

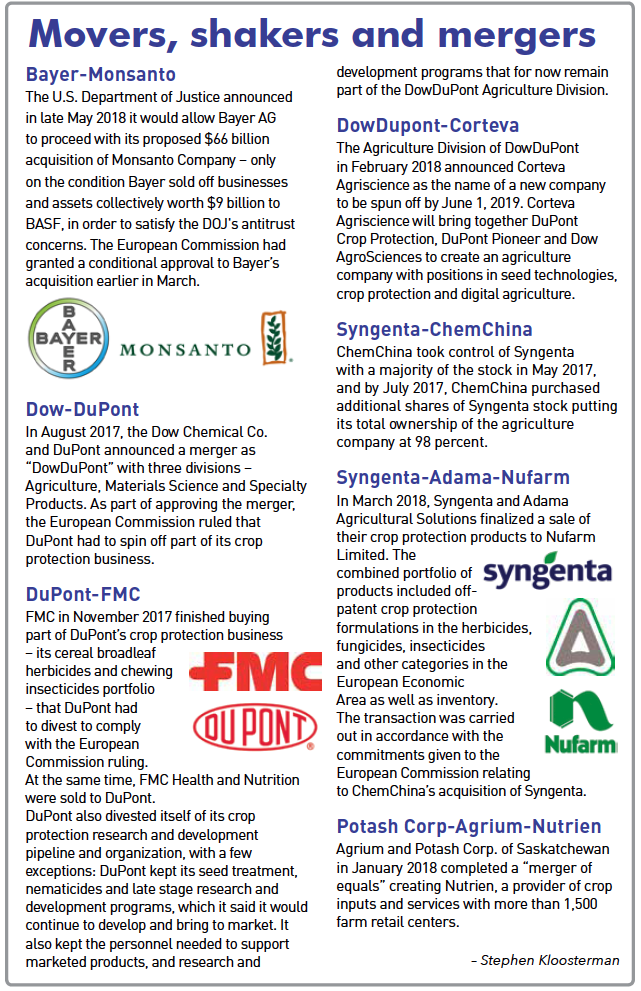

Household names for family farmers – DuPont, FMC, Dow Chemical, Syngenta – have been involved in mergers, acquisitions and complicated transactions. Some of the transactions have been big enough to merit antitrust oversight from the U.S. Department of Justice and the European Commission. Company executives have been upbeat about the resulting changes.

When Dow Chemical merged with DuPont in September, DowDuPont Chief Executive Officer Ed Breen was optimistic about the results.

“DowDuPont is a launching pad for three intended strong companies (agriculture, materials science and specialty products) that will be better positioned to reinvest in science and innovation, solve our customers’ ever-evolving challenges, and generate long-term returns for our shareholders,” he said in a news release. The ag division of DowDuPont will be spun of as a new company, Corteva Agriscience, in 2019.

Not all growers and organizations were as optimistic. One critic was Farmers and Families First, a self-described 501(c)(4) that advocates for “free market-based policies to help the American farmers who grow our nation’s food and help the American families who consume that food.”

“History shows that market concentration comes at the expense of farmers,” Farmers and Families First wrote in a white paper that specifically mentioned the Bayer-Monsanto merger. “As the market for agricultural inputs has consolidated, seed prices for farmers have more than doubled relative to the prices they receive for the resulting crops. Before 1990, the world’s farmers typically purchased seeds with traits amenable to their growing conditions from any of 600 or more small, independent seed businesses, many of them family-owned.”

However, agriculture economist David Zilberman isn’t convinced that mergers will come at the growers’ expense in the long run.

“I don’t really worry about the merger as much as I am excited by the fact that people … invest in technologies that can improve productivity, that can improve a lot of tasks,” Zilberman said in an interview with Fruit Growers News. “How much investment is there? There is a lot, much more than in the past – much of it in harvesting.”

Zilberman is a professor in the Agricultural and Resource Economics Department at the University of California, Berkeley and president-elect of the Agricultural & Applied Economics Association. To him, investment, startup companies with new technologies, the overall expansion of biotechnology and even increased acceptance of genetically modified organisms are good signs that agribusiness is better prepared to deal with the looming problems such as climate change and feeding the world’s growing population.

In an article Zilberman and his colleagues recently published in the peer-reviewed journal Sustainability, the group wrote how GMO-averse Europe seems to be less fearful of the technology.

“A sign of the changing reality is that Bayer, a major European chemical company, is in the process of purchasing Monsanto. The European Commission recently announced the conditional approval of this merger,” the article said.

He earlier wrote a blog post reflecting favorably on the legacy of Monsanto:

“Whatever happens to Monsanto, the vision of using modern technology to enhance agricultural production and address challenges of climate change will endure.”

While fruit and vegetable growers so far have mostly avoided the use of GMOs, in the future biotechnology and other innovations could fill gaps left by vanishing chemical practices such as methyl bromide fumigation.

Not all mergers are driven by purely profit and loss considerations, Zilberman said.

“Some consolidation is a result of a desire to maximize profit,” he said. “Many consolidations are the result of several companies doing what one company can do better on an open market. So, it depends on the situation.

“The fact that many startups have emerged is a good sign,” he added.

– Stephen Kloosterman, VGN Associate Editor

Monsanto’s Grant will leave upon closing of Bayer acquisition

Monsanto’s Grant will leave upon closing of Bayer acquisition