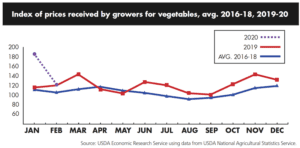

Jul 3, 2020Markets recovering from COVID-19

Vegetable growers’ biggest obstacle seems to be market demand diminished by the COVID-19 pandemic that for months shut down restaurants and food service, and complicated farm operations and distribution.

In early June, growers were getting creative, in some cases finding new outlets for selling vegetables while strengthening their worker safety practices to prepare for harvests. And the worst of that crisis seemed to be in

the past.

“The vegetable industry, in particular, has been very resilient since the first days,” said University of California Agricultural Economist Dan Sumner. While he admitted “we did have some people plow some stuff up early on,” he compared it favorably to the meatpacking industry, which has had production disrupted because of employees sick with the disease.

“My feeling has been that labor supply in agriculture has held up pretty well,” he said. “From the grower point of view, it’s good news.”

Gene McAvoy, a retired University of Florida Extension professor, said the state’s growers enjoyed a great fall and winter growing season before COVID-19 shut down restaurants, Walt Disney World and the cruise lines that they usually supply. South Florida tourists “eat out every morning, every evening, every noon,” he said.

“It looked like it was going to be one of those home-run years,” he said. “The growers in south Florida, where I am, they took the brunt of that hit, because they were at the peak of their season.”

Millions of pounds of vegetables were destroyed or plowed under by growers managing their inventory, he said. Growers also “walked away” from some fields or picked some fields two times instead of three.

But he added that the growers have been creative, moving products from foodservice into retail sales, trading crops with other growers to create mixed produce boxes and other products that food banks can buy.

Sumner agreed that growers did well at re-directing their sales.

“I think we moved fairly quickly through the disruption early on, because you had products that were packaged to go to restaurants, or some packing places set up to deal with restaurants, and then produce was either just the wrong sort or the packaging was not the sort to go to supermarkets,” he said. “And that passed, as people in the industry considered it would – that’s not to say it’s easy. I never want to minimize the hassle that people have to go through.”

As of early June, restaurants in many states were in the process of resuming normal operations, but it was unclear what other challenges growers faced in the markets due to COVID-19. The USDA Economic Research Service (ERS) estimated that farm costs such as fertilizer and fuel are down, while labor costs continue to increase, and labor procedures become more difficult. ERS wrote in an April report that U.S. international trade will likely “slow further in the next few months due to the pandemic-inspired global economic pause.”

As Sumner said, the “uncertainty of knowing” – knowing the disease, knowing the economy during the disease, and knowing how government regulations will shape the market – that uncertainty remains high.

“And then we don’t know about consumer reactions,” he added. “How many consumers are going to feel desperate to get out to go to a restaurant?”

Asparagus

Washington state asparagus came into season about April 20, according to the Facebook account of the Washington Asparagus Commission. The harvest continued strong into mid-May.

In Michigan, cooler-than-average temperatures in late April and early May – and even a late-season snowfall – delayed the harvest by about a week, until mid-May, according to a press release from the Michigan Asparagus Advisory Board. Growers used the extra time to prepare fields and to complete beginning of season tasks like mowing and fertilizer application.

Michigan and California asparagus harvests continued into late May, according to weather reports from the USDA National Agriculture Statistics Service.

Carrots

USDA ERS wrote in an April report that before COVID-19, the amount of fresh carrots being grown and imported had both increased, leading their availability to increase for the third year in a row.

“New products such as various organic carrots as well as carrot packs containing yellow, purple and orange carrots, may be expanding the market,” according to the report. “Signaling favorable demand in the face of rising production, fresh-carrot shipping-point prices rose 8 percent to 19.8 cents per pound, helping to push total crop value up 19 percent to $800 million.”

“We’ve been doing Google surveys on carrot preferences – thousands and thousands of responses,” Sumner said. For responders who say they do regularly buy carrots, the surveys ask “how much extra would you pay for certain kinds of packages, whether it’s baby carrots, or organic carrots or this kind of thing.”

Responses were statically the same from Jan. 1 to late April – the same percentages of people were buying carrots after the COVID-19 pandemic had begun. “I found that interesting,” Sumner said. He was repeating the survey in June.

Leafy greens

Leafy greens marketing groups have continued their organizational efforts to make romaine and other crops safer from foodborne pathogens, and as of early June hadn’t encountered any issues with COVID-19.

“I’ve been very happy we haven’t had a problem, say, in the bagged salad area, where you could imagine something going wrong and then everybody being panicked for a while,” Sumner said.

But Sumner wondered how foodservice sales had been affected by the new coronavirus.

“If you go into any major city, you know every block or two that has offices will have two or three of these salad lunch places – lots and lots of vegetables – but I just don’t see them coming back rapidly until all of the offices are open,” he said. “And it’s the office workers that have been able to work at home.”

Onions

Onions are positioned well. USDA ERS wrote that fresh-market onions last year hit a record price of $17.50 per cwt at the farm gate or first point of sale.

“Normally, higher prices the year before would spur onion growers to consider planting a few extra acres the next year,” according to the report. “However, in 2020 growers may be a bit more cautious given the economic uncertainty caused by the temporary loss of the foodservice market to the social distancing practices forced by the viral pandemic.

“Because bulb onions are one of the top fresh vegetable commodities, because they are less perishable than many other fresh items (especially the storage varieties), and because they are nearly ubiquitous in households nationwide, this commodity subsector likely has more options in weathering the storm.”

Strawberries

The California Strawberry Commission reported in its 2020 Acreage Survey that it expected North American production to increase due to high-yielding varieties and “modest” increases in acres planted in California and Mexico. California’s total fall-planted acreage for winter, spring and summer production was reported up 4.5%, while acreage to be planted in the summer of 2020 for fall production was projected to be up 1.4%.

The California Strawberry Commission’s Survey was published in December 2019 and didn’t reference COVID-19. However, the commission in early April wrote an open letter to its distributors saying it would “harvest every box” during at least through the May harvests.

Sumner thought berries were selling well in an economy where people are eating at home almost exclusively.

“We’ve had an increased demand in home use, so some of the products, like berries, I thought were a higher proportion of supermarket purchases than restaurants in general,” he said. “The more people stay home, the better they’ve done, I think.”

Tomatoes/peppers

Florida tomatoes were harvested in May, and growers are now planting cover crops and following up for the next season.

Meanwhile in California, “the processing tomato crop here is planted,” Sumner said. “I think it’s as big a crop as ever, and it’s going right along.”

USDA ERS said early reports were that California tomato processors intended to contract for 4% more processing tomatoes.

“Since most of the end products are storable, current indications are that the industry intends to move forward with these plans,” according to the USDA’s report.

The news wasn’t as good for field-grown, fresh-market tomatoes.

“Since peaking at the start of 2020, fresh tomato shipping-point prices have trended lower and bottomed out in early April as unsold product from reduced foodservice demand backed up in the supply chain and at farms in central Florida where a majority of spring tomatoes are grown,” according to the USDA’s report.

McAvoy estimated 75-80% of Florida tomatoes, and 50-60% of green peppers were grown for the foodservice market.

— Stephen Kloosterman, associate editor